Provisional Tax is payable in 3 instalments unless a taxpayer qualifies as a new provisional taxpayer, files GST six monthly or adopts the ratio method.

From the 2008-09 year, provisional tax payments are aligned with GST payment dates.

Provisional tax can be calculated using the standard (uplift method), the estimation method or the ratio method if you are registered for GST.

If the result is below $2,500 then no provisional tax is due for the following year.

Provisional Tax For Individuals:

From the 2008-09 year, provisional tax payments are aligned with GST payment dates.

Provisional tax can be calculated using the standard (uplift method), the estimation method or the ratio method if you are registered for GST.

If the result is below $2,500 then no provisional tax is due for the following year.

Provisional Tax For Individuals:

- For individuals, use of money inyerest is payable from the 1st instalment date where their RIT exceeds $50,000 or the taxpayer has estimated their provisional tax.

Provisional Tax for Trusts:

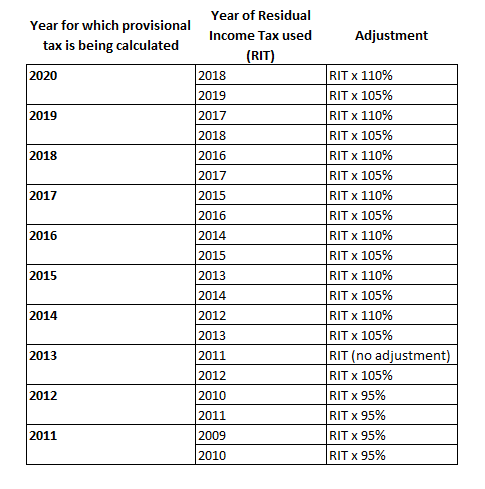

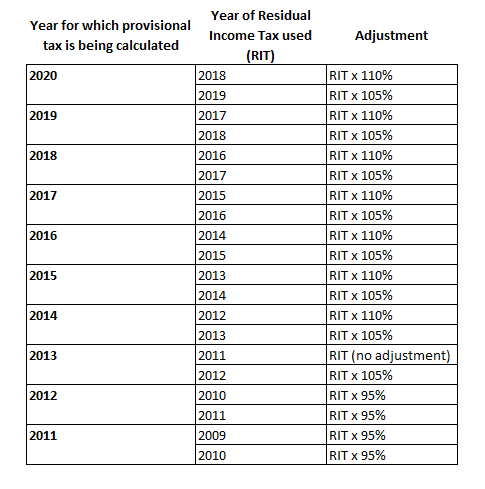

From 2012 onwards is calculated at 105% of the previous years RIT or 110% of the two years previous RIT (eg 110% of 2010 RIT).

Provisional Tax for Smaller Tax Payers (Including Companies and Trusts)

Inland Revenue (IRD) has changed what it calls the "safe harbour" provision.

If:

Provisional Tax for Medium and Larger Taxpayers from 2018 Income Year Onwards

If:

Then:

From 2012 onwards is calculated at 105% of the previous years RIT or 110% of the two years previous RIT (eg 110% of 2010 RIT).

- For non-individuals, use of money interest is payable on shortfall of terminal tax from the 1st instalment date until the terminal tax is paid.

Provisional Tax for Smaller Tax Payers (Including Companies and Trusts)

Inland Revenue (IRD) has changed what it calls the "safe harbour" provision.

If:

- Your actual income tax liability for the year is less than $60,000; and

- You paid the tax amount required as per the standard method at your three provisional tax dates.

- You will not be charged IRD interest if you did not pay enough provisional tax, provided you pay the final balance by your terminal tax date.

Provisional Tax for Medium and Larger Taxpayers from 2018 Income Year Onwards

If:

- Your actual income tax laibility is $60,000 or more; and

- You paid provisional tax for that year based on the standard method.

Then:

- You won't be charged IRD interest if you paid the amounts of tax due as per the standard method at your first and second instalments, even if your actual liability is higher.

- The final balance will be due at your third provisional tax date. IRD interest applies on any underpayment or overpayment of tax from the third provisional tax date.