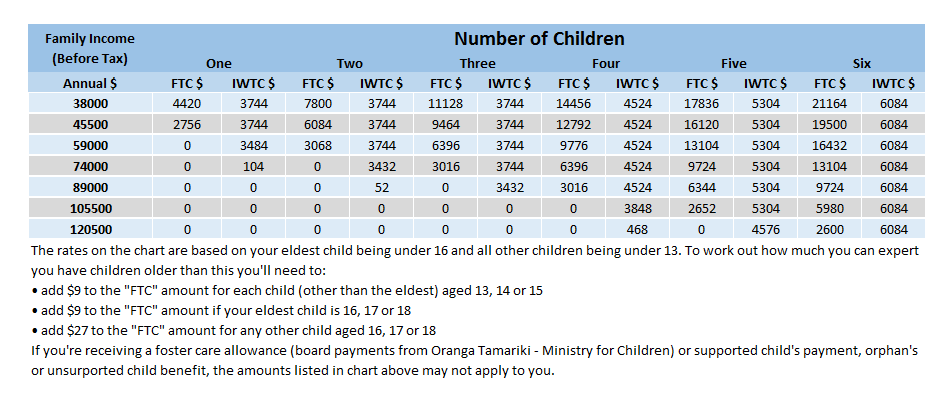

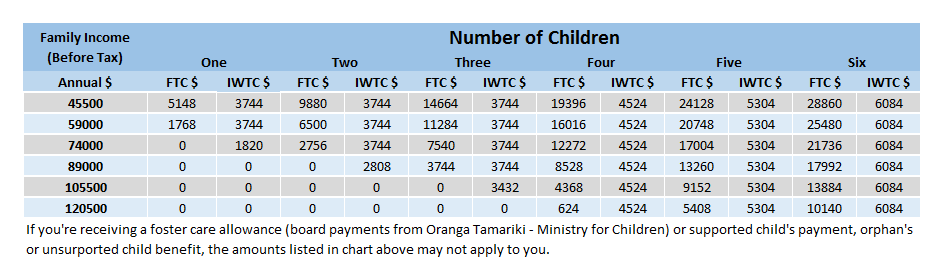

For 1 April 2018 to 31 March 2019: The calculations shown below are based on the eldest child being under 16 and all other children being under 13 years of age. If you have children aged between 16 and 18 see the note below the table*. For more information on Working for Families Tax Credits (previously called family assistance) please visit www.ird.govt.nz/wff-tax-credits.

Families Tax Credits and In-Work Payment

Family Tax Credits are paid regardless of your source of income. In-work tax credits are for families who normally work a minimum number of hours each week.

Families Tax Credits and In-Work Payment

Family Tax Credits are paid regardless of your source of income. In-work tax credits are for families who normally work a minimum number of hours each week.

Families Tax Credits and In-Work Payment (1 April 2018 to 30 June 2018)

Families Tax Credits and In-Work Payment (1 July 2018 to 31 March 2019)

Minimum Family Tax Credit

If your family income (for the year ended 31 March 2019, after tax) is below $26,156 a year, you may also be entitled to a family tax credit

.

Parental Tax Credit

For children born before 1 July 2018, replaced by Best Start tax credit (details below) commencing 1 July 2018.

This is a payment for up to 10 weeks after a new child arrives in your family. You can receive up to $2,200 depending on your family income.

The amount will depend on:

Best Start tax credit

Best Start tax credit is a weekly payment of $60 (up to $3120 per year) per child for a baby born on or after 1 July 2018. if your baby is due on or after 1 July 2018 but is born earlier than 1 July you are still eligible.

For the first year of the baby's life the family's income is not taken into account. For families earning less than $79,000, Best Start will continue at $60 per week until the child turns 3. If the family income is more than $79,000, payments will reduce or stop depending on your income.

Best Start will be started paying from 1 July 2018 to customers whose babies are born on or after 1 July 2018.

Notes:

You can't receive the parental tax credit and Best Start payments for the same child.

To be eligible for Best Start:

Extension to Paid Parental Leave

Paid parental leave is extending from 18 weeks to 22 weeks from 1 July 2018. This also includes an increase in "Keeping in Touch" hours from 40 to 52 hours.

If your baby is due on or after 1 July 2018 but arrives late or early, you may also be eligible for 22 weeks paid parental leave.

If your family income (for the year ended 31 March 2019, after tax) is below $26,156 a year, you may also be entitled to a family tax credit

.

Parental Tax Credit

For children born before 1 July 2018, replaced by Best Start tax credit (details below) commencing 1 July 2018.

This is a payment for up to 10 weeks after a new child arrives in your family. You can receive up to $2,200 depending on your family income.

The amount will depend on:

- Family Income (before tax)

- The number of dependent children in your care

- The age of these children, and

- The number of newborn children

Best Start tax credit

Best Start tax credit is a weekly payment of $60 (up to $3120 per year) per child for a baby born on or after 1 July 2018. if your baby is due on or after 1 July 2018 but is born earlier than 1 July you are still eligible.

For the first year of the baby's life the family's income is not taken into account. For families earning less than $79,000, Best Start will continue at $60 per week until the child turns 3. If the family income is more than $79,000, payments will reduce or stop depending on your income.

Best Start will be started paying from 1 July 2018 to customers whose babies are born on or after 1 July 2018.

Notes:

You can't receive the parental tax credit and Best Start payments for the same child.

To be eligible for Best Start:

- you must be the principal caregiver of the child

- you must be a New Zealand resident or citizen and have been in New Zealand for a continuous period of 12 months at any time

- a New Zealand tax resident

- you must have an IRD number for the child you will get Best Start payments for

- the child you are claiming for is both a resident and present in New Zealand.

Extension to Paid Parental Leave

Paid parental leave is extending from 18 weeks to 22 weeks from 1 July 2018. This also includes an increase in "Keeping in Touch" hours from 40 to 52 hours.

If your baby is due on or after 1 July 2018 but arrives late or early, you may also be eligible for 22 weeks paid parental leave.